As a registered 501(c)(3), MC-US is registered on multiple charitable donation platforms which support individual donations and corporate matching, these include Guide Star where MC-US has a Platinum Seal of Transparency, Charity Navigator, The Life You Can Save, ReThink Charity Forward, Giving What We Can, PayPal, Benevity Fund, Your Cause, Bright Funds, Social for Good Fund, Charities Aid Foundation of America, United Way, and Amazon Smile.

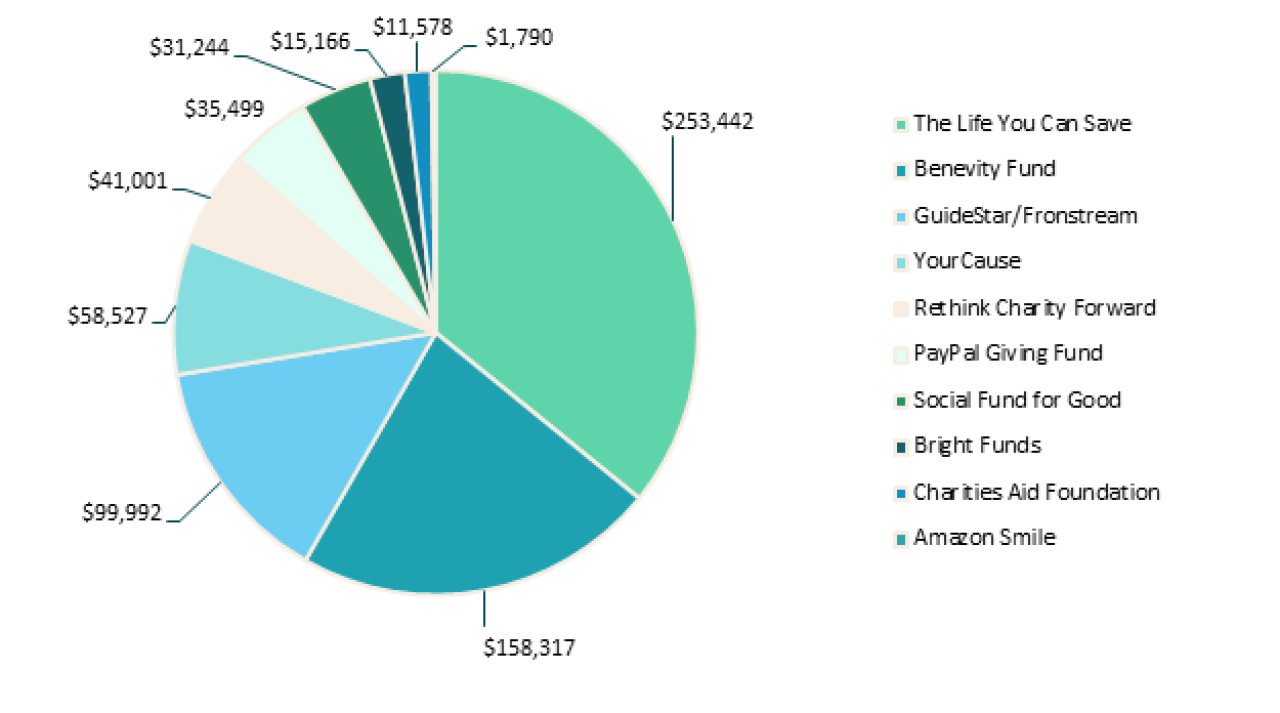

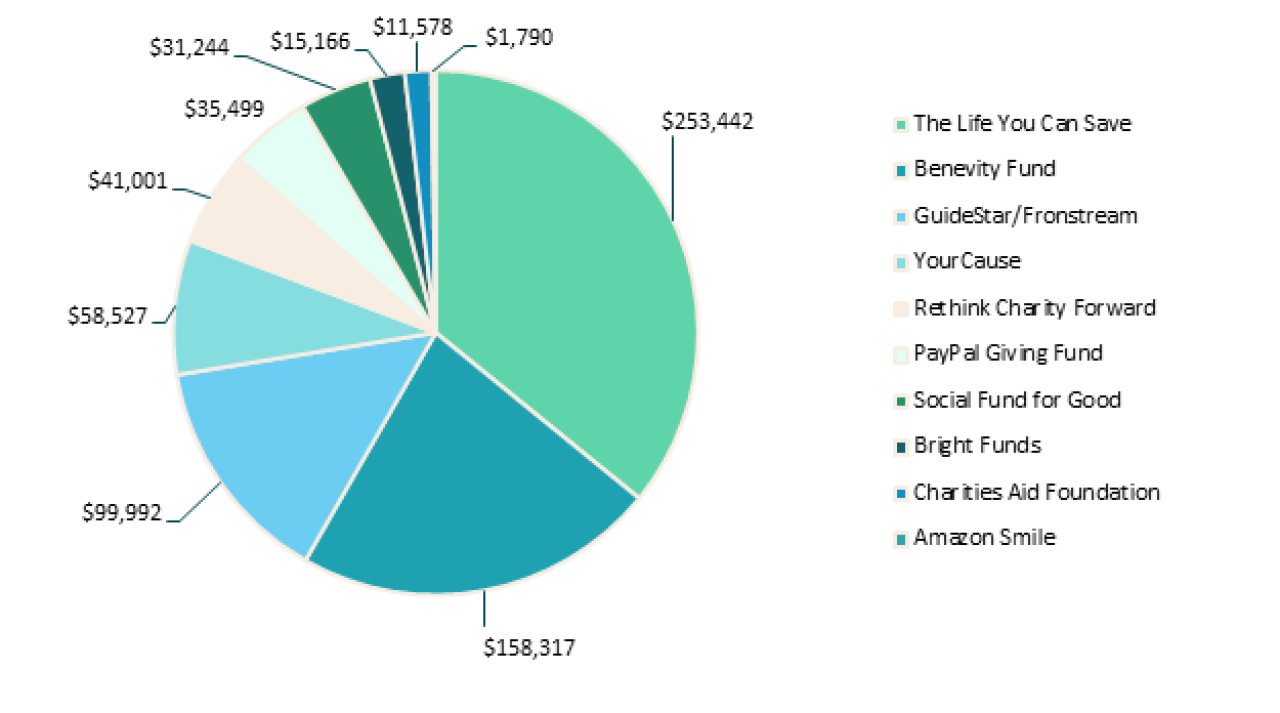

The following charitable organizations and platforms contributed a total of $706,556 in FY21.

The below outlines all charitable donation platforms through which MC-US receives funds.

The Life You Can Save is based on the ideology of founder Peter Singer, this organisation selects charities based on effectiveness and so is largely influenced by the recommendations of GiveWell. Malaria Consortium receives periodic donations from this organisation and occasionally assists the organisation to communicate to their users about Malaria Consortium’s SMC work. All donations received from this organisation are restricted to the SMC program.

Benevity Fund is a Canadian organization which provides charitable donation-management and grant-management platforms for individual and corporate donors including 250 of the Fortune 1000 companies.

Guide Star manages one of the largest data base repositories of information on every non-profit registered with the IRS as tax exempt. Their mission is to providing information that advances transparency, enables users to make better decisions, and encourages charitable giving. GuideStar is a 501(c)(3) public charity

YourCause NPO Connect is a free portal that nonprofits can use to create a charity profile to receive and manage donations from a network of over 500 organizations who are active participants in social good.

ReThink Charity Forward is a Canadian cause-neutral donation routing fund for high-impact charities around the world. All donations received from this organization are restricted to the SMC program.

PayPal Giving Fund is the charity platform that powers donations made via PayPal itself and other platforms including eBay. Malaria Consortium receives periodic disbursements from this stream as a result of their users choosing to add a donation to their purchases and then selecting MC-US as the beneficiary.

Social for Good Fund helps to sponsor and develop projects that will help positively impact and develop global communities into healthier and happier places to live, work, and be.

Bright Funds powers a technology platform for employee giving.

Charities Aid Foundation of America is a non-profit organization which provides grant making services for donor advised funds, donor advised gifts, employee giving programs, and charity friends funds.

Giving What You Can is an effective altruism-associated organization whose members pledge to give at least 10 percent of their income to effective charities. All donations received from this organisation are restricted to the SMC program.

Charity Navigator is a charity assessment organization that evaluates charitable organizations based in the United States, operating as a non-profit 501© (3) non-profit organization

United Way is an international network of over 1,800 local non-profit fundraising affiliates.

Amazon Smile is a service offered by Amazon that allows shoppers to choose a charity to benefit from their purchases at no cost to them. For each eligible purchase made under this service, Amazon donates 0.5 percent to the shopper’s chosen charity.

platinum-level Guidestar participant,

platinum-level Guidestar participant,